Chinese government economic policy known as Special Economic Zones (or Free Trade Zones) was implemented in 2013 as part of a comprehensive plan to support and promote foreign direct investment in a variety of industries that vary by location. The primary goal of the first special economic zones (SEZ) was to advance global trade. In 2013, Shanghai became the first authorized Free Trade Zone (FTZ), and in 2015, Guangdong, Tianjin, and Fujian followed.

In free trade zones, merchandise may be brought in, handled, manufactured, modified, and reexported without the involvement of regional customs officials. The items are not subject to the current customs charges until they are transported to customers inside the province where the zone is situated.

Companies with registered offices in these SEZs and who are registered there receive the following benefits:

- lower rates of corporate tax

- Exemption from import taxes until the items are removed from the SEZ (out of the warehouse)

- Free exchange rate for currencies (no fees for converting major currencies)

- A quick and efficient customs clearance.

- A selection of vendors for logistical, pick-and-pack, and transportation services is available here. All located very close by.

- A quicker return of VAT

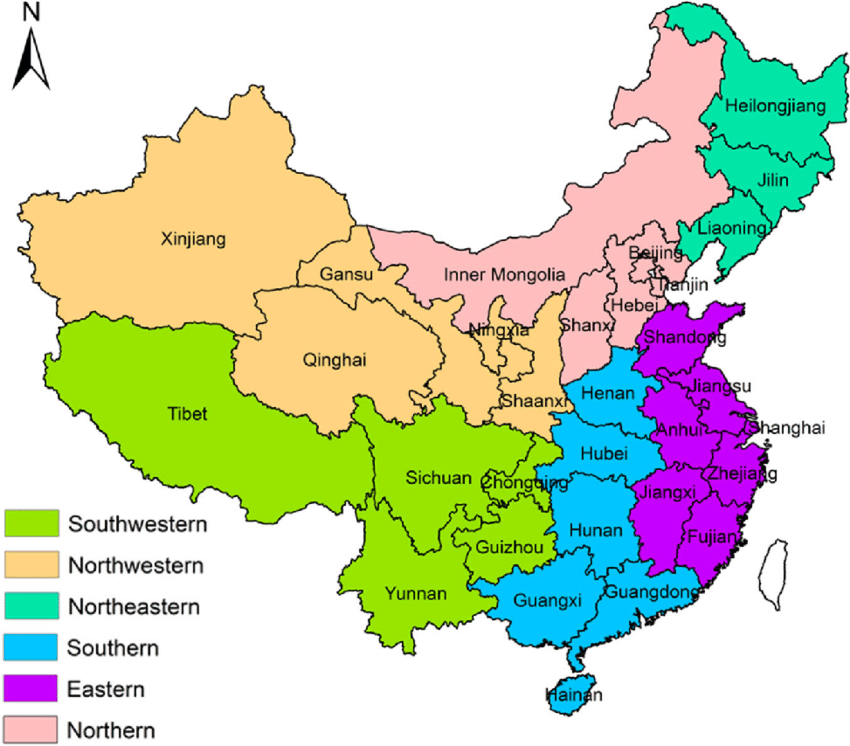

Overview of China’s 21 Free Econimic Zones

1. Shanghai FTZ Website: http://en-shftz.pudong.gov.cn

Industries of interest: International trade and finance

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

2. Guangdong FTZ website: http://ftz.gd.gov.cn/Eng/

Industries of interest: International trade and finance

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

3. Tianjin FTZ website: https://www.tjftz.gov.cn/english/

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

4. Fujian FTZ website: http://www.china-fjftz.gov.cn/html/en/index.html

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

5. Chongqing. Liangjiang new area: new technologies and biotechnologies

Liangjiang FTZ website: http://enljxqfy.chinacourt.gov.cn/index.shtml

Xiyong: Microelectronic activities and high tech

Guoyang port: logistics and trade

Chengdu: IT & communications, logistics, vehicle import, financial services, high-end manufacturing, high-tech Industries, air-transportation related economy and port services

Chengdu FTZ website: http://ftz.chengdu.gov.cn/FTA/home.shtml

Policies:

- A faster and streamlined customs clearance depending on HS code of product.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

6. Sichuan. Xi’an: high-end manufacturing, aviation logistics, trade, financial services, tourism, exhibition services and e-commerce.

Xianyang: Agricultural science and technology.

7. Shaanxi FTZ website: http://en.xa.gov.cn/business/whyxian/2242.htm

Policies:

- A faster and streamlined customs clearance depending on HS code of product.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

8. Henan province

Zhengzhou: development of advanced manufacturing industries,such as high‑end equipment, automobile production and biomedicine. It will also promote a range of high-end services such as logistics, e‑commerce, financial services, service outsourcing, design and trade conferences/exhibitions.

Zhengzhou FTZ website: http://en.zzftz.gov.cn/

Kaifang: Service outsourcing, medical tourism, tourism, cultural trade, design, fine art trading and logistics equipment manufacturing, agricultural processing and related trade activities.

Kaifang FTZ website: http://www.kfftz.gov.cn/

Luoyang: High‑end manufacturing such as equipment manufacturing, robotics and innovative materials, R&D, design, e‑commerce, service outsourcing, tourism, cultural and creative industries, cultural trade and cultural exhibitions.

Luoyang FTZ website: http://www.china-lyftz.gov.cn

Henan FTZ website: http://en.zzftz.gov.cn/zcfg/143.jhtml

Policies:

- Foreign capital can be freely invested into suitable manufacturing in the region.

- Restriction on foreign-owned manufacturing (factory) operations are lifted in the region.

- IP rights are enforced and foreign manufacturers are protected.

- Issue permanent residency to high-level foreign talents and their spouses / dependents.

9. Zhejiang province

Ningbo: international petrochemical and shipping hub for wet bulk trade. (Oil and gas)

Ningbo FTZ website: http://www.nftz.gov.cn/col/col1229026785/index.html

Hangzhou: AI, fintech, life sciences, e-commerce and high-tech manufacturing.

Hangzhou FTZ website: http://www.ehangzhou.gov.cn/index.html

Jinyi: commodity, logistics, and manufacturing

Zhejiang FTZ website: https://zcom.zj.gov.cn/art/2018/2/27/art_1455357_15652993.html

Policies:

- A more open financial investment sector to foreigners

- Trade facilitation and innovation

10. Hubei province

Wuhan: International commerce and trade, financial services, logistics, R&D, design, and emerging industries such as but not limited to optoelectronics information, advanced manufacturing, and biomedicine.

Yichang: Cultural tourism, biomedicine, R&D, shipping logistics, equipment manufacturing, and the high-tech industry.

Xiangyang: Manufacturing of high-end equipment, new-energy vehicles, logistics, trade, product exhibition, e-commerce, big data, cloud computing and other services.

Hunan FTZ website: http://en.hubei.gov.cn/news/newslist/201609/t20160907_894646.shtml

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

11. Liaoning province

Dalian: port and shipping logistics, financial trade, advanced equipment manufacturing, high-tech and new technology, circular economy, shipping services and other industries.

Shenyang: advanced manufacturing, auto vehicles and auto components, aviation equipment, modern services including finance, science and technology and logistics.

Yingkou: services, trade logistics, cross-border e-commerce, finance, strategic emerging industries, information technology and high-end equipment manufacturing.

Liaoning FTZ website: http://www.china-lnftz.gov.cn/en/index.html

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

- Foreign capital can be freely invested into suitable manufacturing in the region.

- Restriction on foreign-owned manufacturing (factory) operations are lifted in the region.

- IP rights are enforced and foreign manufacturers are protected.

- Issue permanent residency to high-level foreign talents and their spouses / dependents.

12. Hainan Island/province. Capital: Haikou

Industries of interest: International trade and finance

Hainan FTZ website: http://en.hnftp.gov.cn/

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

13. Jiangsu province

Suzhou: trade and investment, administrative services, legal system, aerospace and biomedical science.

Nanjing: semiconductors, life and health industry, AI, IT and finance.

Lianyungang: advanced manufacturing such as biomedicine, new materials, new energy and high-end equipment, logistics, cross-border e-commerce, technology services, financial services, health care, leisure, tourism, business support, big data, port and shipping logistics, distribution and transshipment, warehousing, port processing, trading and supporting services.

Jiangsu FTZ website: http://swt.jiangsu.gov.cn/col/col79303/index.html

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

14. Shandong. Qingdao Free Trade Port Zone: marine industries, foreign trade, shipping logistics, financial services, advanced manufacturing, exchange market, bonded processing.

Qingdao FTZ Website: http://bofcom.qingdao.gov.cn/

Jinan: AI, industrial financial services, health care and elderly care, tourism and IT.

Yantai: high-end manufacturing, new materials, IT, green-tech and biomedicine.

Policies:

- Lower corporate tax rates between 15% and 9%

- Import tax exemption until goods are moved out of the SEZ (out of the warehouse)

- Free currency exchange rate (no fees for converting major currencies)

- A fast and streamlined customs clearance.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

- Faster VAT refund

15. Hebei. Xiongan Area: IT, life science, e-commerce, biotechnology and high-tech related services.

Zhengding Area: airport economy, biomedicine, logistics, high-end equipment manufacturing, aviation.

Caofeidian Port Area: international commodity trade, port and shipping services, energy storage and distribution and high-end equipment manufacturing.

Daxing Airport Area: aviation logistics, aviation technology and financial leasing.

Policies:

- A faster and streamlined customs clearance depending on HS code of product.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

16. Heilongjiang province

Harbin: next‑gen IT, novel materials, high‑end equipment, biomedicine, tech-based services, financial services and tourism.

Heihe: cross‑border energy resources, food cultivation, trade, logistics, tourism, healthcare and financial services.

Suifenghe: import processing for materials such as timber, grains and clean energy, financial services and logistics.

Heilongjiang FTZ Website: http://ftz.heihe.gov.cn/

Policies:

- A faster and streamlined customs clearance depending on HS code of product.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

17. Guangxi province

Nanning: financial services, logistics, digital services, culture and media and new manufacturing industries.

Nanning FTZ website: http://www.wuxiangxinqu.gov.cn/

Qinzhou port: port logistics, international trade, ‘green’ chemicals, new‑energy vehicle parts, electronics and biomedicine.

Qinzhou FTZ website: http://qzftz.qinzhou.gov.cn/

Chongzuo: international trade, logistics, financial services and tourism.

Guangxi FTZ Website: http://en.gxzf.gov.cn/guangxiftz.html

Policies:

- A faster and streamlined customs clearance depending on HS code of product.

- A hub of transportation, pick and pack and logistic service providers to choose from. All nearby.

18. Yunnan province

Kunming FTZ: high-end manufacturing, aviation logistics, agriculture, biomedicine and health, IT F&B and consumer goods manufacturing, tourism, logistics, new materials and advanced equipment manufacturing.

Kunming FTZ website: https://ftz.yn.gov.cn/en-us/

Dehong: Imports & exports, cross-border e-commerce logistics, ‘green’ food processing, tourism, medical and financial services.

Dehong FTZ website: http://dehong.ynmaker.com/en-us/

Honghe: Imports & exports, cross-border e-commerce logistics, tourism, medical and financial services.

Honghe FTZ website: http://honghe.ynmaker.com/en-us/

19. Beijing

Industry of interest: Innovation, fin-tech and services

Purpose: Development of a world-class innovation hub

Policies:

- A more open financial sector to foreigners

- Trade facilitation and innovation

- Ease of integrated development and international trade

- Easier for high-end talent to obtain visa

20. Anhui province

Hefei: integrated circuits, AI, fin-tech, and cross-border e-commerce

Wuhu: smart home appliances, aviation, robotics, and shipping

Bengbu: silicon-based materials, green-tech, and green-energy

Purpose: The area will lead manufacturing of green-tech and high-tech

Policies:

- A more open financial sector to foreigners

- Trade facilitation and innovation

- Ease of integrated development and international trade

21. Hunan province

Changsha: Manufacturing of AI, Quantum computing, renewable energies, and green tech.

Yueyang: Manufacturing of AI, Quantum computing, renewable energies, and green tech.

Chenzhou: Manufacturing of AI, Quantum computing, renewable energies, and green tech.

Policies:

- Trade facilitation and innovation

- Ease of integrated development and international trade