China boasts a rich tradition of brewing and consuming alcohol, stretching back 9,000 years. As early as 7,500-7,000 BCE, the Chinese crafted their inaugural alcoholic concoction by blending rice, grapes, honey, and hawthorn fruits. Throughout its history, alcohol has permeated every facet of Chinese culture, art, philosophy, and daily life. In 2022, the spirits market in China achieved a substantial turnover of about 319.8 billion EUR. This robust figure not only presents a lucrative opportunity for domestic producers keen to secure a portion of the Chinese spirits market, but also attracts foreign investors who recognize the immense potential of this market segment.

Baijiu Claims Top Honors as the Most Popular Spirit China boasts a diverse array of alcoholic beverages. In 2021, the two most favored choices were spirits and beer, accounting for 47.8% and 39.1% of the market revenue, respectively. Wine followed in third place, contributing 8.2% of the total revenue. Among spirits, Baijiu towers above its competitors. Translating to “white spirit,” Baijiu is distilled from sorghum, though it can also be produced from rice, wheat, millet, and corn. This spirit reigns as the predominant alcoholic beverage in China, with sales amounting to 603 billion RMB (approx. 77.2 billion EUR) in 2021. According to the National Bureau of Statistics, Baijiu’s cumulative production volume reached 2.02 billion liters by March 2022, showcasing a remarkable 60% growth compared to February figures. Baijiu’s significance was underscored when 24 bottles of the premium brand Kweichow Moutai were auctioned for 1.4 million EUR at Sotheby’s, the preeminent art and luxury marketplace.

The Baijiu market is flourishing as well. In 2022, six of the ten most valuable spirit brands in China are Chinese, all of which produce Baijiu. Leading the pack is Moutai, valued at 43 billion EUR. While Baijiu holds dominion over production and revenue in China, other spirits also play a crucial role in the market, with notable examples including Whiskey, Brandy, and Vodka.

Gender and Generational Trends in Consumption While China boasts an ancient tradition of alcohol production, drinking is not a preferred activity. In 2022, the average annual alcohol consumption per person in China stood at 6 liters, significantly lower than countries like France, where the figure reaches 12 liters annually. This consumption pattern varies by gender, with men consuming nearly 10 liters compared to women’s modest 3 liters.

As for age distribution, the younger demographic, particularly Generation Z, is taking the reins of the spirits market. A striking 57% of frequent pub-goers fall within the 18 to 24 age bracket. This youthful generation serves as the primary driving force behind China’s alcohol market. To streamline the purchasing process, numerous alcohol delivery platforms have emerged. Established in 1998, “1919” is one such platform. In 2018, Alibaba invested 288 million EUR to expand the presence of 1919.cn in China, with plans to open over 2,000 stores the following year. The platform’s strengths include promotions and a swift 19-minute delivery, albeit limited to specific cities.

Evolving Drinking Habits Among the Youth The youth constitute the backbone of China’s spirits market. Despite the deep-rooted tradition and customs surrounding alcohol consumption, the newer generations are striving to curb excessive drinking, especially during working hours. A pivotal incident contributing to this shift occurred in 2021, when a Chinese woman employed by Alibaba accused her superior of sexual assault. The woman claimed she was coerced into drinking during a business dinner, leading to the misconduct. Traditional etiquette dictates that young individuals should propose toasts to superiors and clients as a sign of respect and hospitality. This custom, viewed as a vestige of patriarchal legacy from ancient China, is being challenged by the younger generations. Despite a reduction in workplace alcohol consumption, the consumption of alcoholic beverages among young people remains robust, particularly within the context of the “night economy.” This term encompasses activities occurring between 6 p.m. and 6 a.m., projected to amount to 5.7 trillion EUR (40 trillion RMB) in 2022. Nighttime eateries contribute to 40% of the night economy, while bars account for 19%, representing a vital component of social interaction, especially for Generation Z.

Domestic versus Imported Offerings Although the domestic spirits market in China is thriving, there is a noticeable demand for imported alcoholic beverages. France predominantly caters to this demand, emerging as the largest exporter of alcoholic beverages to China in the first half of 2022, with a total value of 847 million EUR. Foreign liquors are perceived as status symbols in China, often featured during dinners and social gatherings. Brandy took the lead among imported spirits in 2021, constituting 68% of the total import value and representing an import volume of 48.71 million liters. France maintains its supremacy in brandy imports, commanding a dominant 98.8% (1.68 billion EUR) market share in 2021. In the realm of Whiskey, England stands as the predominant exporter, accounting for 80.1% (371.74 million EUR) of China’s whiskey import market in 2021. Japan holds the second spot, contributing a mere 10.91% (50.61 million EUR) of the market share during the same year.

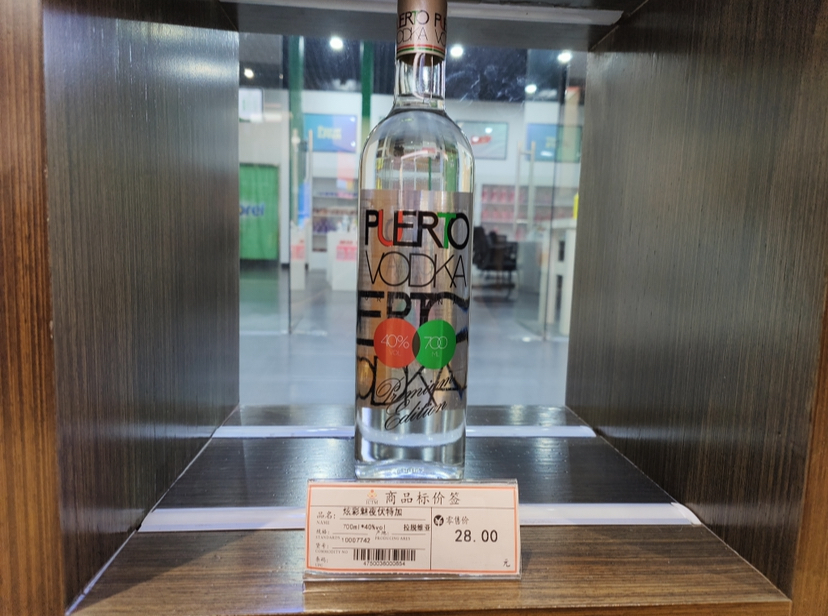

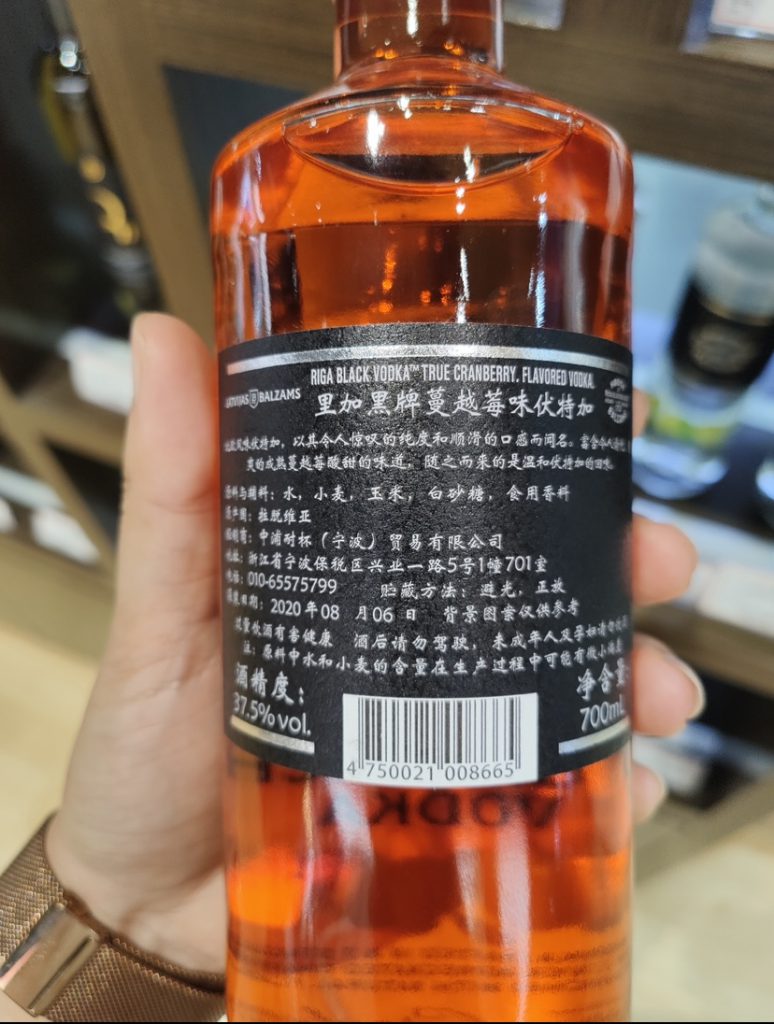

Vodka also plays a significant role in imports, with China sourcing vodka from 40 countries, and Sweden emerging as the primary exporter. In 2020, the most consumed vodka brand in China was “Absolut Vodka” from Sweden, capturing a noteworthy 52.7% share of consumption volume. Although these figures appear substantial, they pale in comparison to Baijiu’s extensive distribution and popularity. In 2020, Baijiu commanded a staggering 94% of liquor sales in China, while the combined sales of whiskey and brandy amounted to a modest 5%.

Thriving Prospects in China’s Spirited Market China’s ancient drinking culture continues to wield influence in contemporary society and social interactions. Baijiu maintains a robust presence in China’s alcohol economy, serving as the quintessential national liquor and one of the world’s most renowned spirits. Despite the younger generations’ aspirations to modernize the traditional drinking culture, many young people, especially Generation Z, continue to frequent pubs and purchase alcoholic beverages to foster social connections. Consequently, the spirits market remains buoyant. Digitalization is reshaping the alcohol market, facilitated by platforms like 1919.cn, which offer convenient deliveries even in lower-tier cities. As exemplified by brandy and whiskey, China’s spirits market presents a treasure trove of opportunities for foreign brands seeking to make their mark.

Phots: Latvijas Balzams Vodka in stores in China